- CAR LOAN PAYMENT CALCULATOR WITH CREDIT SCORE HOW TO

- CAR LOAN PAYMENT CALCULATOR WITH CREDIT SCORE REGISTRATION

Once you find the car you want to buy, you usually know its price. If you are shopping around for car loans, you may check our loan comparison calculator, which can give you excellent support in choosing the most favorable option. If you're considering buying a recreational vehicle, check our RV loan calculator.

CAR LOAN PAYMENT CALCULATOR WITH CREDIT SCORE HOW TO

We will also explain to you step by step how to calculate the monthly payments on any car loan and how to take into account sales tax.

CAR LOAN PAYMENT CALCULATOR WITH CREDIT SCORE REGISTRATION

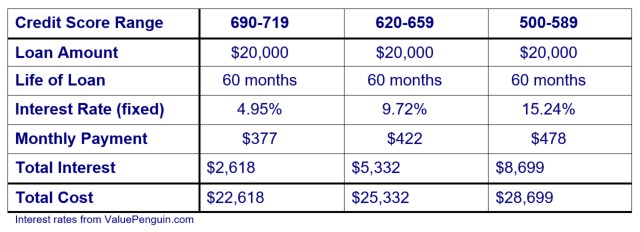

You’ll also pay to renew your registration every one, two or three years. To legally drive your vehicle you must pay registration fees, documentation fees and taxes that you’ll pay when you purchase the car. If you’re unsure of how much to budget, visit to view the fuel economy or gas mileage and projected annual fuel costs for the year for the make and model of the vehicle you select. Use Edmund’s car maintenance calculator to get an estimate of how much you’ll spend to maintain your vehicle. These costs can start at around $100 per visit but vary by the make and model of your vehicle. Make sure you understand car insurance rates and the best car insurance companies available in order to select the best car insurance coverage for your needs. So, you can expect an older car to carry higher rates.īeyond the cost of monthly car loan payments, vehicle ownership costs can add up. An older vehicle can carry additional risk of issues for both you and your lender. This means you can still benefit from a competitive rate if you have a strong profession or educational background - with or without a perfect credit score. Many lenders are expanding underwriting criteria outside of the sole measure of your credit score. But a longer-term loan will decrease your monthly payment. Typically, a longer-term loan will equate to higher interest rates and more interest paid over the life of the loan. Putting down a large down payment will not only bode well with lenders but will decrease the amount you are borrowing - saving you more money down the line. Very simply, the lower your credit score is, the higher your interest rate will be. Lenders use credit scores to measure the risk that borrowers carry. Consider these aspects and how they will affect loan approval and rates: While it is true that the interest rate you will receive varies depending on the lender and is somewhat out of your control, there are still choices you can make to increase approval. What factors contribute to auto loan interest rates? What’s the difference between new and used car interest rates? Caret Down

Be sure to apply for preapproval and shop multiple lenders. With all of this in mind, consider approaching your next loan with extra care. Lenders will also look at your credit score, amount financed and your loan term. The Fed opted against raising rates in June and again in September.īut while the federal funds rate influences lender’s rates, it is not the only consideration. So even as sky-high vehicle prices have finally fallen below sticker price in March after two years above, the increase in interest rates will still result in a more expensive experience overall. The increased Fed rate, sitting at 5.25 percent to 5.5 percent following the July meeting, will indirectly affect your rates. All of this might make the cost to finance your next car more expensive. While vehicle prices are beginning to steady as remaining supply chain issues are resolved, increasing rates from the Federal Reserve meant to slow inflation are complicating the issue.

0 kommentar(er)

0 kommentar(er)